Al Brooks Trading Price Action Reversals Pdf Creator

Trading Price Action Reversals: Technical Analysis of Price Charts Bar by Bar for the Serious Trader (Wiley Trading series) by Al Brooks. Read online, or download in secure PDF or secure EPUB format.

IMPORTANT: MT4talk.com is a public Forex forum, where forum members can upload open source Forex robots to share with other members. MT4talk.com forum does not sell or rent Forex robots, and does not provide guarantee or support for the uploaded Forex robots! If you have any question about any Forex robot, please open a forum topic!

If you have a question about your forum account, contact: mt4talk@gmail.com CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS, IN GENERAL, ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN. Disclaimer - No representation is being made that any Forex account will or is likely to achieve profits or losses similar to those shown on backtests in this forum.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. All information on this forum is for educational purposes only and is not intended to provide financial advice. Any statements posted by forum members about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. Intel e210882 harakteristiki. Mac os x lion torrent.

You accept full responsibilities for your actions, trades, profit or loss, and agree to hold the MT4talk team and forum members of this information harmless in any and all ways.

1) Major trend reversals A bull trend is a series of higher lows and highs, and a bear trend is a series of lower highs and lows. Trading a major trend reversal pattern is an attempt to enter at the start of a new trend, hoping that a series of trending highs and lows will follow.

Since traders are entering before the new trend is clear, the probability of even the best looking setup is usually only 40%. These traders are looking for low risk (a tight stop), but that almost always comes with low probability. The math is good for both these early entry traders and for those who wait for the strong breakout into a clear trend.

The components of a major trend reversal include a Trend Pullback that breaks out of channel Resumption of the trend 2nd pullback that grows into opposite trend There were several major trend reversal (MTR) buy setups. Buying above bar 1 would have resulted in a small loss, and buying above bar 2 would have created a small profit or a breakeven trade. Buying above either bars 3, 4, or 5 would have resulted in a profit that was many times greater than the risk, and the wedge bottom increased the chances of a swing up. Many traders prefer higher probability trades and would have begun to buy around the close of bar 6, after the strong breakout. The odds of higher prices in the form of different measured moves at that point were at least 60%. The trade-off was that the risk was greater (the stop was below the bottom of the bull leg, like below bar 3 or 4). GOOG had a failed breakout above the top of a bull channel and then a micro double top that was followed by a strong measured move down, well below the bottom of the channel.

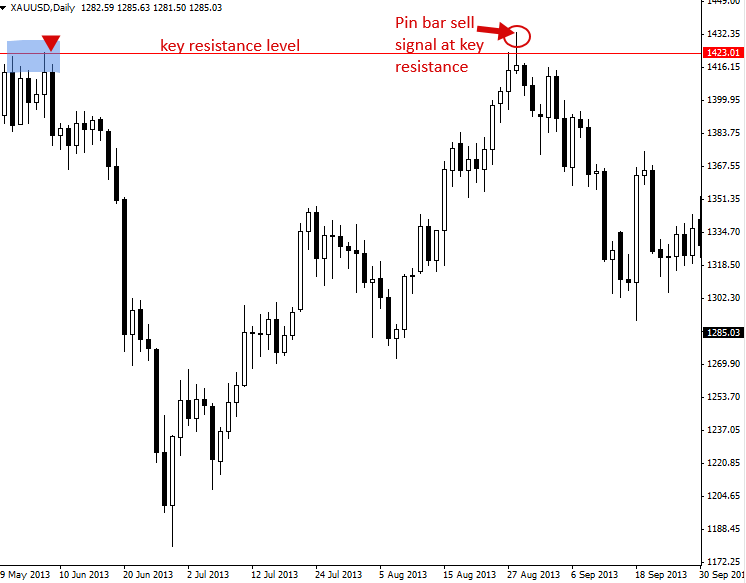

Bears were alerted to look to sell the next rally, betting that it would fail to go above the bull high and instead be followed by at least a 2nd leg down. They shorted below the bar 3 lower high, which was a successful lower high major trend reversal (it was also a small wedge bear flag). The market entered a broad bear channel and bears shorted each strong rally, expecting it to fail to get above the prior lower high. 2)Final flags The components of a final flag are Trend Pullback that is usually mostly horizontal.